The nervousness of investors while deciding which debt mutual fund to choose is the biggest factor in delayed or wrong investments. To determine the most suitable debt fund to invest in, investors must check the credit quality. This defines the creditworthiness of the portfolio, or the quality of the cumulative assets in the funds, which reassures investors about the safety and expected returns from the debt funds. This credit quality is determined by credit rating agencies.

Credit Rating Agencies in India

There are 6 major credit rating agencies in India. These are:

- Credit Rating Information Services of India Limited (CRISIL)

- Investment Information and Credit Rating Agency of India (ICRA) Limited

- Credit Analysis and Research Limited (CARE)

- India Rating and Research Private Limited

- Acuité Ratings & Research

- Brickwork Ratings India Private Limited

Credit Rating Scales

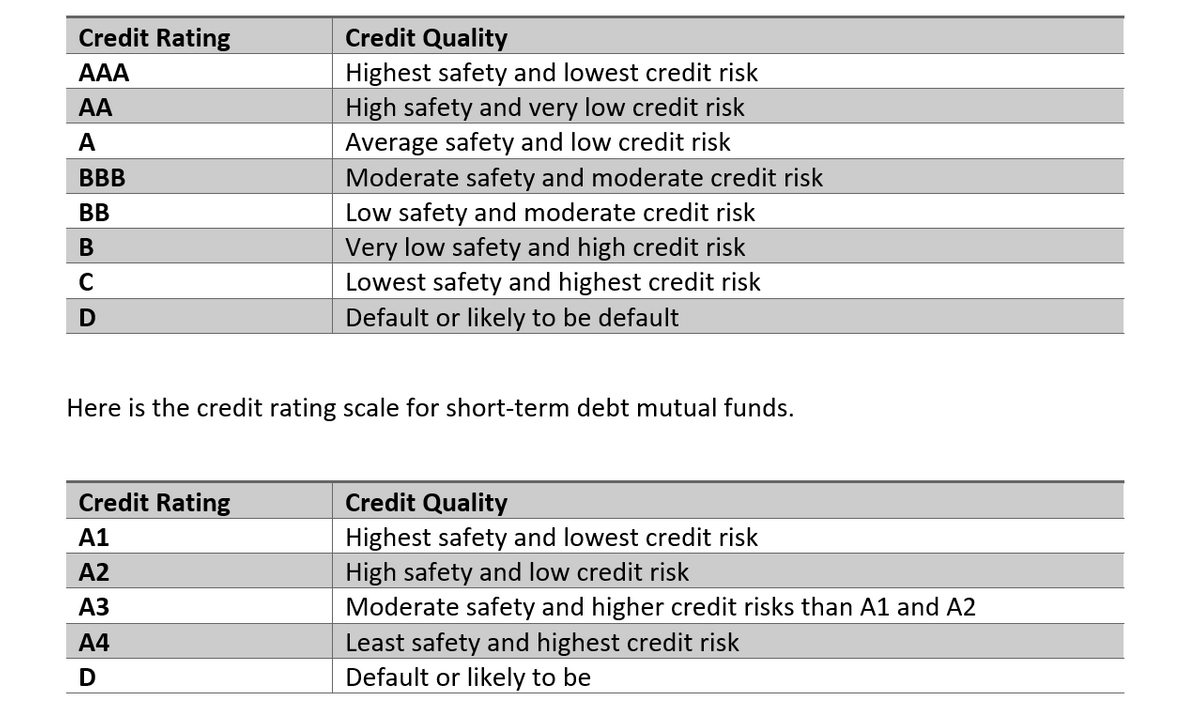

Broadly speaking, there are two types of debt funds. This classification is based on the duration. So, the two types are short-term and long-term debt funds. Based on the timeframe, there are also two types of credit rating scales.

Here is the credit rating scale for long-term funds in mutual fund investment.

Importance of Credit Quality

Investors need to know the credit rating of the debt funds they are investing in. Here is why understanding the importance of credit quality of debt mutual funds is important.

- It allows the investors to understand the creditworthiness of the fund they want to invest in. It shows how responsible the fund is and allows the investors to think about where to invest their money.

- It allows you to identify which debt funds will provide more returns with the least risks. Investors can choose funds on the basis of their goals set.

- When the investor deposits funds in a debt fund, it is actually the company acting as a borrower. Credit quality shows the level of risks the particular fund has and helps investors make better investment decisions. Higher rating companies will have less risk and will attract more investors.

- Knowing the credit quality of the borrowers ensures the investors that their money will be paid back to them with the correct interest rates and on time.

- The credit quality of the top debt funds saves the time and effort of the investors while researching the perfect scheme for investment.

- Credit quality assures the investors that they are investing in the right place as the rating is performed by industry experts after a detailed evaluation of the performance of the company.

Conclusion

By checking the credit quality of the debt fund, investors can be assured that they are depositing their funds in the right place. The highest-rated debt mutual funds keep your money in the safest possible way.